Provide 10 Depreciation On Furniture . new irs laws for furniture depreciation. select the type of furniture, purchase price, and the number of years owned to determine the current value due to. furniture loses half its value in just two years. percentage (declining balance) depreciation calculator. Depending on the value of the used furniture, you may no longer need to break out the abacus to figure out depreciation. You can also depreciate certain intangible. depreciation on furniture is a part of furniture cost price, charged as an expense in an accounting period. Knowing what affects depreciation, like how much you use it and. This is because with every passing year, the. you can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. When an asset loses value by an annual percentage, it is known as declining.

from ceujwrtw.blob.core.windows.net

depreciation on furniture is a part of furniture cost price, charged as an expense in an accounting period. This is because with every passing year, the. You can also depreciate certain intangible. Depending on the value of the used furniture, you may no longer need to break out the abacus to figure out depreciation. select the type of furniture, purchase price, and the number of years owned to determine the current value due to. When an asset loses value by an annual percentage, it is known as declining. furniture loses half its value in just two years. new irs laws for furniture depreciation. you can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. percentage (declining balance) depreciation calculator.

How Many Years To Depreciate Furniture at Yvonne Farfan blog

Provide 10 Depreciation On Furniture Depending on the value of the used furniture, you may no longer need to break out the abacus to figure out depreciation. select the type of furniture, purchase price, and the number of years owned to determine the current value due to. This is because with every passing year, the. you can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. Knowing what affects depreciation, like how much you use it and. new irs laws for furniture depreciation. When an asset loses value by an annual percentage, it is known as declining. furniture loses half its value in just two years. percentage (declining balance) depreciation calculator. Depending on the value of the used furniture, you may no longer need to break out the abacus to figure out depreciation. You can also depreciate certain intangible. depreciation on furniture is a part of furniture cost price, charged as an expense in an accounting period.

From dhnalupseco.blob.core.windows.net

Office Furniture Depreciation Rate Canada at Linda Palomino blog Provide 10 Depreciation On Furniture You can also depreciate certain intangible. Knowing what affects depreciation, like how much you use it and. This is because with every passing year, the. furniture loses half its value in just two years. you can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. percentage (declining balance) depreciation calculator.. Provide 10 Depreciation On Furniture.

From www.pinterest.com

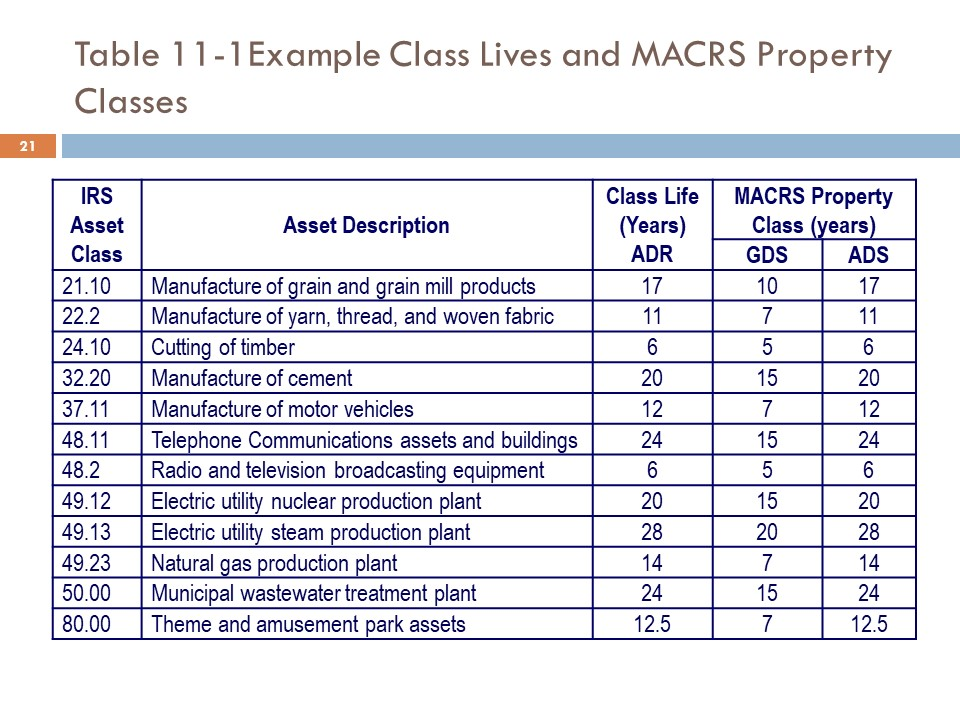

Macrs Depreciation Table Furniture for Home Office Check more at http Provide 10 Depreciation On Furniture percentage (declining balance) depreciation calculator. You can also depreciate certain intangible. select the type of furniture, purchase price, and the number of years owned to determine the current value due to. depreciation on furniture is a part of furniture cost price, charged as an expense in an accounting period. Depending on the value of the used furniture,. Provide 10 Depreciation On Furniture.

From censylpj.blob.core.windows.net

Residential Furniture Depreciation Life at Larry Echols blog Provide 10 Depreciation On Furniture Knowing what affects depreciation, like how much you use it and. This is because with every passing year, the. depreciation on furniture is a part of furniture cost price, charged as an expense in an accounting period. When an asset loses value by an annual percentage, it is known as declining. select the type of furniture, purchase price,. Provide 10 Depreciation On Furniture.

From www.slideteam.net

Calculation Of Depreciation On Fixed Assets Depreciation Expense Ppt Provide 10 Depreciation On Furniture depreciation on furniture is a part of furniture cost price, charged as an expense in an accounting period. new irs laws for furniture depreciation. you can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. When an asset loses value by an annual percentage, it is known as declining. . Provide 10 Depreciation On Furniture.

From haipernews.com

How To Calculate Depreciation Expense Haiper Provide 10 Depreciation On Furniture percentage (declining balance) depreciation calculator. select the type of furniture, purchase price, and the number of years owned to determine the current value due to. new irs laws for furniture depreciation. Knowing what affects depreciation, like how much you use it and. When an asset loses value by an annual percentage, it is known as declining. You. Provide 10 Depreciation On Furniture.

From eireneignacy.blogspot.com

Calculate furniture depreciation EireneIgnacy Provide 10 Depreciation On Furniture You can also depreciate certain intangible. depreciation on furniture is a part of furniture cost price, charged as an expense in an accounting period. Depending on the value of the used furniture, you may no longer need to break out the abacus to figure out depreciation. you can depreciate most types of tangible property (except land), such as. Provide 10 Depreciation On Furniture.

From concepthack.com

ConceptHack Depreciation, Amortisation & Deferred Expense Provide 10 Depreciation On Furniture select the type of furniture, purchase price, and the number of years owned to determine the current value due to. Knowing what affects depreciation, like how much you use it and. This is because with every passing year, the. You can also depreciate certain intangible. percentage (declining balance) depreciation calculator. furniture loses half its value in just. Provide 10 Depreciation On Furniture.

From quickbooks.intuit.com

What is depreciation and how is it calculated? QuickBooks Provide 10 Depreciation On Furniture Depending on the value of the used furniture, you may no longer need to break out the abacus to figure out depreciation. This is because with every passing year, the. furniture loses half its value in just two years. depreciation on furniture is a part of furniture cost price, charged as an expense in an accounting period. When. Provide 10 Depreciation On Furniture.

From slidecourse.blogspot.com

Useful Life Of Furniture For Depreciation Slide Course Provide 10 Depreciation On Furniture depreciation on furniture is a part of furniture cost price, charged as an expense in an accounting period. percentage (declining balance) depreciation calculator. You can also depreciate certain intangible. furniture loses half its value in just two years. new irs laws for furniture depreciation. Knowing what affects depreciation, like how much you use it and. . Provide 10 Depreciation On Furniture.

From censylpj.blob.core.windows.net

Residential Furniture Depreciation Life at Larry Echols blog Provide 10 Depreciation On Furniture select the type of furniture, purchase price, and the number of years owned to determine the current value due to. You can also depreciate certain intangible. you can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. When an asset loses value by an annual percentage, it is known as declining.. Provide 10 Depreciation On Furniture.

From www.studocu.com

FMA solved question ppr 2023 reg a) Closing stock is Rs. 240, b Provide 10 Depreciation On Furniture Knowing what affects depreciation, like how much you use it and. Depending on the value of the used furniture, you may no longer need to break out the abacus to figure out depreciation. you can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. select the type of furniture, purchase price,. Provide 10 Depreciation On Furniture.

From staceysidra.blogspot.com

Calculate depreciation on furniture StaceySidra Provide 10 Depreciation On Furniture Knowing what affects depreciation, like how much you use it and. you can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. When an asset loses value by an annual percentage, it is known as declining. select the type of furniture, purchase price, and the number of years owned to determine. Provide 10 Depreciation On Furniture.

From askfilo.com

e. Depreciate plant and machinery by 10 p.a. and furniture by 20 p.a.R.. Provide 10 Depreciation On Furniture You can also depreciate certain intangible. furniture loses half its value in just two years. you can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. Depending on the value of the used furniture, you may no longer need to break out the abacus to figure out depreciation. new irs. Provide 10 Depreciation On Furniture.

From exooapsto.blob.core.windows.net

How Much Does Furniture Depreciate at Martin blog Provide 10 Depreciation On Furniture new irs laws for furniture depreciation. Knowing what affects depreciation, like how much you use it and. depreciation on furniture is a part of furniture cost price, charged as an expense in an accounting period. you can depreciate most types of tangible property (except land), such as buildings, machinery, vehicles, furniture, and equipment. furniture loses half. Provide 10 Depreciation On Furniture.

From exooapsto.blob.core.windows.net

How Much Does Furniture Depreciate at Martin blog Provide 10 Depreciation On Furniture When an asset loses value by an annual percentage, it is known as declining. percentage (declining balance) depreciation calculator. furniture loses half its value in just two years. select the type of furniture, purchase price, and the number of years owned to determine the current value due to. Knowing what affects depreciation, like how much you use. Provide 10 Depreciation On Furniture.

From www.scribd.com

Furniture PDF Expense Depreciation Provide 10 Depreciation On Furniture depreciation on furniture is a part of furniture cost price, charged as an expense in an accounting period. select the type of furniture, purchase price, and the number of years owned to determine the current value due to. When an asset loses value by an annual percentage, it is known as declining. you can depreciate most types. Provide 10 Depreciation On Furniture.

From ceujwrtw.blob.core.windows.net

How Many Years To Depreciate Furniture at Yvonne Farfan blog Provide 10 Depreciation On Furniture new irs laws for furniture depreciation. You can also depreciate certain intangible. percentage (declining balance) depreciation calculator. Depending on the value of the used furniture, you may no longer need to break out the abacus to figure out depreciation. Knowing what affects depreciation, like how much you use it and. select the type of furniture, purchase price,. Provide 10 Depreciation On Furniture.

From www.doubtnut.com

The following is the account of cash transactions of the Nari Kalaya Provide 10 Depreciation On Furniture new irs laws for furniture depreciation. This is because with every passing year, the. When an asset loses value by an annual percentage, it is known as declining. furniture loses half its value in just two years. You can also depreciate certain intangible. Depending on the value of the used furniture, you may no longer need to break. Provide 10 Depreciation On Furniture.